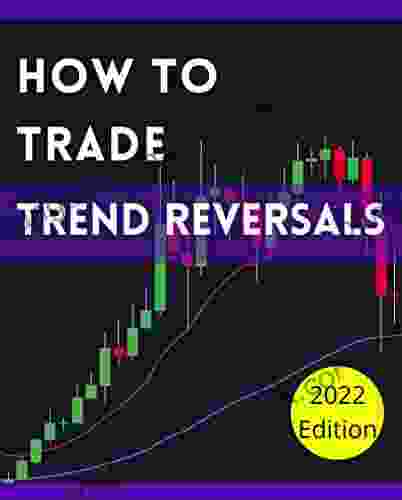

The Ultimate Guide to Trading Trend Reversals

5 out of 5

| Language | : | English |

| File size | : | 2922 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 79 pages |

| Lending | : | Enabled |

Trend reversals are a common occurrence in the financial markets, and they can provide traders with significant opportunities for profit. However, identifying and trading trend reversals can be a challenging task, even for experienced traders. In this article, we will provide you with a comprehensive guide to trading trend reversals, including the different types of trend reversals, the factors that can cause them, and the strategies that you can use to profit from them.

What is a Trend Reversal?

A trend reversal is a change in the direction of a trend. Trends can be uptrends, downtrends, or sideways trends. A trend reversal occurs when the price action breaks out of the current trend and begins to move in the opposite direction.

There are two main types of trend reversals: bull trend reversals and bear trend reversals. A bull trend reversal occurs when a downtrend reverses and begins to move up. A bear trend reversal occurs when an uptrend reverses and begins to move down.

What Causes Trend Reversals?

There are a number of factors that can cause trend reversals, including:

- Economic data: Economic data can have a significant impact on the financial markets. For example, a strong economic report can cause stocks to rise, while a weak economic report can cause stocks to fall.

- Political events: Political events can also have a significant impact on the financial markets. For example, a change in government can cause stocks to rise or fall, depending on the policies of the new government.

- Natural disasters: Natural disasters can also cause trend reversals. For example, a hurricane or earthquake can cause stocks to fall, as investors worry about the impact of the disaster on the economy.

- Technical factors: Technical factors can also cause trend reversals. For example, a break below a key support level can trigger a sell-off, while a break above a key resistance level can trigger a rally.

How to Identify Trend Reversals

There are a number of technical indicators that can be used to identify trend reversals. Some of the most common indicators include:

- Moving averages: Moving averages are a popular way to identify trend reversals. A moving average is a line that shows the average price of a security over a specified period of time. When the price of a security breaks above or below its moving average, it can indicate a trend reversal.

- Bollinger Bands: Bollinger Bands are a type of moving average that shows the volatility of a security. When the price of a security breaks above the upper Bollinger Band, it can indicate a trend reversal. When the price of a security breaks below the lower Bollinger Band, it can indicate a trend reversal.

- Relative Strength Index (RSI): The RSI is a momentum indicator that shows the strength of a trend. When the RSI rises above 70, it can indicate that a trend is overbought and that a trend reversal is likely. When the RSI falls below 30, it can indicate that a trend is oversold and that a trend reversal is likely.

How to Trade Trend Reversals

There are a number of different strategies that you can use to trade trend reversals. Some of the most common strategies include:

- Fading: Fading is a strategy that involves selling a security when it reaches a key resistance level. The idea behind fading is that the trend is likely to reverse and that you will be able to profit from the decline.

- Breakouts: Breakouts are a strategy that involves buying a security when it breaks above a key resistance level. The idea behind breakouts is that the trend is likely to continue and that you will be able to profit from the rally.

- Pullbacks: Pullbacks are a strategy that involves buying a security when it falls back to a key support level. The idea behind pullbacks is that the trend is likely to continue and that you will be able to profit from the rally.

Tips for Trading Trend Reversals

Here are a few tips for trading trend reversals:

- Use multiple indicators: Don't rely on just one indicator to identify trend reversals. Use a combination of indicators to confirm your analysis.

- Be patient: Trend reversals can take time to develop. Don't be in a hurry to enter a trade. Wait for the trend to confirm before you pull the trigger.

- Manage your risk: Trend reversals can be volatile. Always use a stop-loss order to protect your profits.

- Don't overtrade: Trend reversals can be tempting, but don't overtrade. Only trade the reversals that fit your trading plan.

Trading trend reversals can be a profitable strategy, but it is important to do your research and understand the risks involved. By using the tips and strategies outlined in this article, you can increase your chances of success when trading trend reversals.

5 out of 5

| Language | : | English |

| File size | : | 2922 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 79 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Kenley Obas

Kenley Obas Xavier Portilla Edo

Xavier Portilla Edo Amanda Jernigan

Amanda Jernigan Amber Argyle

Amber Argyle Mary N Rowan

Mary N Rowan Alphonse De Lamartine

Alphonse De Lamartine Raymond Boyd Dunn

Raymond Boyd Dunn Gloria Edmonson Nelson

Gloria Edmonson Nelson J R Moehringer

J R Moehringer Ronnie Bachman

Ronnie Bachman Ellery Adams

Ellery Adams John Etzil

John Etzil Mary Stone

Mary Stone Ruchi Agarwal Rangnath

Ruchi Agarwal Rangnath Roger Mcgough

Roger Mcgough Sara Ackerman

Sara Ackerman Shelby Foote

Shelby Foote Judith Kolberg

Judith Kolberg Tracy Dennis Tiwary

Tracy Dennis Tiwary Timothious Smith

Timothious Smith

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Forrest BlairFollow ·11k

Forrest BlairFollow ·11k Kurt VonnegutFollow ·14.5k

Kurt VonnegutFollow ·14.5k Isaiah PriceFollow ·10.9k

Isaiah PriceFollow ·10.9k John UpdikeFollow ·11.8k

John UpdikeFollow ·11.8k J.R.R. TolkienFollow ·3.7k

J.R.R. TolkienFollow ·3.7k Gary CoxFollow ·7.8k

Gary CoxFollow ·7.8k David Foster WallaceFollow ·5.3k

David Foster WallaceFollow ·5.3k Everett BellFollow ·8.1k

Everett BellFollow ·8.1k

Yukio Mishima

Yukio MishimaUnveiling the Zimmermann Telegram: A Pivotal Document in...

The Zimmermann Telegram, a diplomatic...

George Martin

George MartinFearful Stories and Vile Pictures to Instruct Good Little...

In the annals of children's literature, few...

Grant Hayes

Grant HayesJessica the Viscount Wallflower: A Tale of Transformation...

In the opulent ballrooms and glittering...

Jerome Blair

Jerome BlairThe Economics of the Global Defence Industry: A...

The global...

Blake Kennedy

Blake KennedyBreath of Heron - A Window into the Poetic Depths of...

In the realm of...

5 out of 5

| Language | : | English |

| File size | : | 2922 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 79 pages |

| Lending | : | Enabled |