Money Inflation and Business Cycles: A Comprehensive Guide

Money inflation and business cycles are two closely related concepts that have a profound impact on the economy. Inflation is a sustained increase in the general price level of goods and services in an economy over time. Business cycles, on the other hand, are fluctuations in economic activity over time, characterized by periods of expansion and contraction.

Understanding the relationship between money inflation and business cycles is crucial for policymakers and businesses alike. This guide aims to provide a comprehensive overview of these topics, exploring their causes, effects, and potential policy responses.

4.3 out of 5

| Language | : | English |

| File size | : | 2114 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 172 pages |

| Screen Reader | : | Supported |

Causes of Money Inflation

Inflation can arise from several factors, including:

- Excessive money growth: When the central bank or government prints too much money, it can lead to an increase in the money supply, causing prices to rise.

- Demand-pull inflation: When aggregate demand, the total demand for goods and services in an economy, exceeds aggregate supply, it can create inflationary pressures. This can occur during periods of strong economic growth or due to factors such as a surge in consumer spending or government spending.

- Cost-push inflation: When the cost of production increases due to factors such as rising wages, transportation costs, or commodity prices, businesses may pass on these costs to consumers in the form of higher prices.

Effects of Money Inflation

Inflation can have a wide range of effects on the economy, including:

- Erosion of purchasing power: As prices rise, the value of money decreases, reducing the purchasing power of consumers and businesses.

- Distortion of investment decisions: Inflation can make it difficult for businesses to make long-term investment decisions, as it creates uncertainty about the future cost of capital and the value of investments.

- Wage-price spiral: Workers may demand higher wages to keep up with rising living costs, which in turn can put upward pressure on prices, creating a self-reinforcing cycle.

Business Cycles

Business cycles are characterized by alternating periods of economic growth and contraction. The four main phases of a business cycle are:

- Expansion: A period of economic growth, characterized by rising output, employment, and consumer spending.

- Peak: The highest point of economic activity in a cycle, where the economy is operating at or near full capacity.

- Contraction (or recession): A period of economic decline, characterized by falling output, employment, and consumer spending.

- Trough: The lowest point of economic activity in a cycle, where the economy is experiencing significant unemployment and underutilized resources.

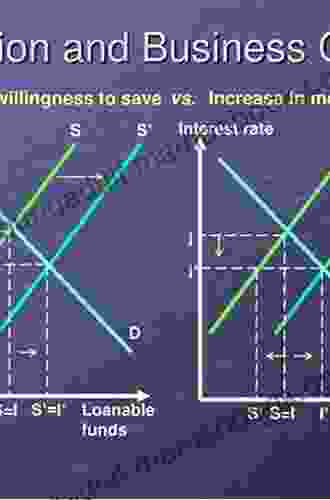

Relationship Between Money Inflation and Business Cycles

Money inflation and business cycles are closely related. Excessive money growth can contribute to demand-pull inflation, which in turn can stimulate economic growth and lead to an expansionary phase of the business cycle. However, if inflation becomes too high, it can undermine consumer and business confidence, leading to a contractionary phase.

Conversely, a contractionary phase of the business cycle can lead to lower demand for goods and services, resulting in a decrease in the rate of inflation. In some cases, a severe economic downturn can even lead to deflation, where the general price level falls over time.

Policy Responses to Money Inflation and Business Cycles

Policymakers have a range of tools to manage money inflation and business cycles, including:

- Monetary policy: The central bank uses tools such as interest rate adjustments and quantitative easing to influence the money supply and control inflation.

- Fiscal policy: The government uses fiscal policy tools such as taxes and spending to influence aggregate demand and manage business cycles.

- Supply-side policies: Policies aimed at improving productivity, such as tax incentives for investment and education, can help to address cost-push inflation and support long-term economic growth.

Money inflation and business cycles are complex and interconnected phenomena that can have a significant impact on the economy. Understanding the relationship between these two concepts is essential for policymakers and businesses to effectively manage the economy and mitigate the risks associated with inflation and business fluctuations. By implementing appropriate policy measures, it is possible to minimize the negative effects of these phenomena and promote sustainable economic growth.

4.3 out of 5

| Language | : | English |

| File size | : | 2114 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 172 pages |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Ann Hood

Ann Hood Julian Stockwin

Julian Stockwin Jim Toner

Jim Toner Rebecca Otowa

Rebecca Otowa George Saoulidis

George Saoulidis Lise Mcclendon

Lise Mcclendon S J Heyworth

S J Heyworth Maurice Bloomfield

Maurice Bloomfield Al Ewing

Al Ewing Antonio Libertino

Antonio Libertino Michael Bernick

Michael Bernick Tish Thawer

Tish Thawer Vijaylaxmi Thakur

Vijaylaxmi Thakur Sara Ackerman

Sara Ackerman Emma Tallon

Emma Tallon J B Hagen

J B Hagen Vauhini Vara

Vauhini Vara Jennifer Cook O Toole

Jennifer Cook O Toole Hunni Bloom

Hunni Bloom Norman Morrow

Norman Morrow

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

William WordsworthFollow ·17.9k

William WordsworthFollow ·17.9k Edward ReedFollow ·10.7k

Edward ReedFollow ·10.7k Ed CooperFollow ·15.8k

Ed CooperFollow ·15.8k Tony CarterFollow ·8.6k

Tony CarterFollow ·8.6k Hugh BellFollow ·9.1k

Hugh BellFollow ·9.1k Gabriel MistralFollow ·7.1k

Gabriel MistralFollow ·7.1k Dashawn HayesFollow ·5.5k

Dashawn HayesFollow ·5.5k Gene PowellFollow ·4.2k

Gene PowellFollow ·4.2k

Yukio Mishima

Yukio MishimaUnveiling the Zimmermann Telegram: A Pivotal Document in...

The Zimmermann Telegram, a diplomatic...

George Martin

George MartinFearful Stories and Vile Pictures to Instruct Good Little...

In the annals of children's literature, few...

Grant Hayes

Grant HayesJessica the Viscount Wallflower: A Tale of Transformation...

In the opulent ballrooms and glittering...

Jerome Blair

Jerome BlairThe Economics of the Global Defence Industry: A...

The global...

Blake Kennedy

Blake KennedyBreath of Heron - A Window into the Poetic Depths of...

In the realm of...

4.3 out of 5

| Language | : | English |

| File size | : | 2114 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 172 pages |

| Screen Reader | : | Supported |